History – Dither AI

Launch

Dither AI launched on December 28th, 2023. I seeded a pool with $500 USDC and 96% of the supply of $DITH. I put out a tweet, intending the project to die, but it grew into a $62M market cap token with aspirations and a completely different goal from its initialization. Since then, we have toggled between $4M and $20M market cap, testing countless narratives. We are now committing to one more: Applied AI on Solana.

Dither began as a fairly simple idea: What if we applied dithering to a financial instrument? At high volumes, natural price stability/efficiency in price discovery occurs because high volume induces natural variations, averaging out noise over the sampling period. Dither on smaller caps, from a signal perspective, should do the same.

Dither is defined as adding white noise to a digital recording to reduce distortion of low-amplitude signals. Generally, it’s adding random (white) noise to signals, then sampling at a lower frequency to improve the signal. It is used in digital recording, WWII bomb timers, and even ultra-high precision gas spectroscopy. It seemed fun to test in a financial setting.

Dither to Dither AI

I get obsessive about ideas. I wanted to test Dither because it was an interesting idea – Price is a measurement over the prior period of price movement. However, I was already deep into another research project involving transformer-based time-series model training. Using a laptop and tiny models, I was testing theories.

“Man plans and God laughs.” I have been in the Solana ecosystem since 2021, and my friends in the space supported and proliferated my experiment. We soon increased the market cap over 200x, and I felt responsible for the Dither project. We had a Dither bot which dithered the price with proportional buys and sells. Everything was going very well.

Eventually, I decided to combine the Dither project with my AI project, and Dither AI was born. To bring attention to Dither and to test the dithering theory at scale, I committed to using my new time-series model to build a signal bot. We removed the dithering bot entirely and focused exclusively on AI.

It was around this time that I became we. The team formed from individuals I had met, who were genuine and interested in helping the project. I believe in our current team and everyone who has helped us in the past.

The Fall and Consolidation

From a market cap of $500, we reached a height of $62M. The speculation of new technology was doomed to fail when met with reality. During the memecoin craze of Spring 2024, it seemed like we had created something great, spawning an entire meta. While other Solana projects fell to irrelevance, we persisted, though we also fell from those memecoin highs.

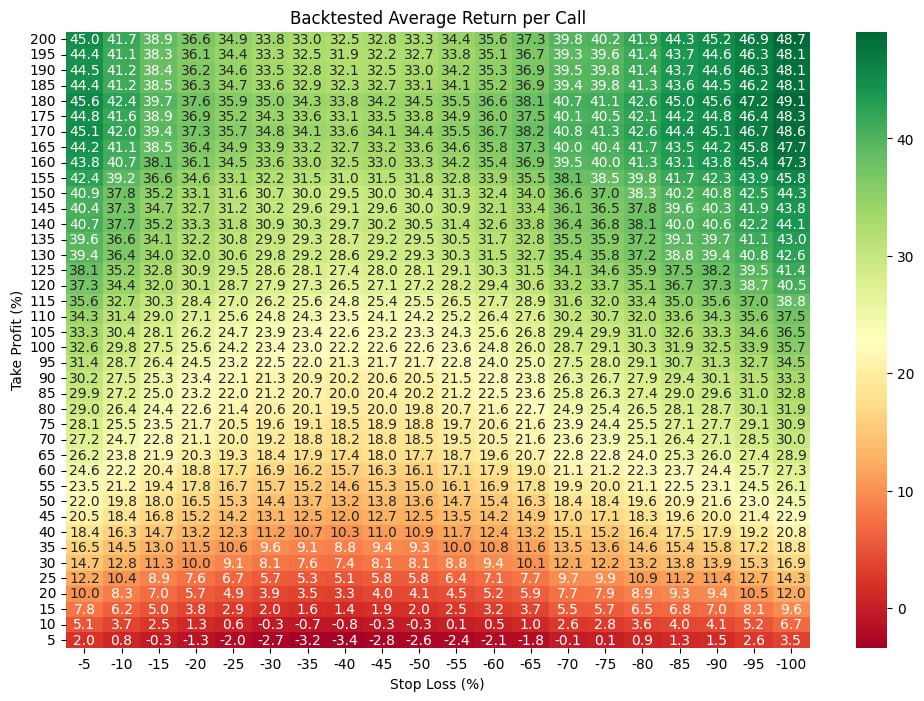

SeerBot was initially a success, backtested by community members and effective at finding signal in the noise.

Markets move quickly, however. A model effective during exuberance was less effective in the summer’s market chop. I’m not going to sugarcoat my failures:

- We prioritized tools over research

- We pushed out tools that needed more testing because of unreasonable deadlines

- We focused on low signal niches

When SeerBot began to lose effectiveness, we had two options: focus on tooling or research. I waffled between these due to internal and external pressures, even though I wanted to complete more research.

The biggest fault of mine was the attention on newly launched tokens. Signals from market movements are quick to appear and disappear in low caps, making it difficult to maintain an edge. We spent a lot of time here instead of perfecting large caps and moving downwards.

Going Forward

Tools and explorations I have promised have been delivered. Functionally, they could be better, but the limitations stem from the underlying model. With the proper base model developed, we will have most areas of signaling covered. We could be a single month from our “ChatGPT moment” or over a year. I am committed to correcting past mistakes.

I will be working more publicly with future demos, focusing on exploring the relationship between cutting-edge AI systems and crypto. We will continue to develop our demos and share fun experiments, maintaining our commitment to research.

Research is a commitment. Tooling will be perfected when we have a powerful enough model. Premium users will still get early access to our cutting-edge demos, and these will be sent to the public faster for broader integration.

We intend to allow anyone to build on Dither tech, so we can focus on research while others develop tools for traders. Instead of a vertical system where we operate everything, I want to pursue an applied AI layer on Solana.

If you want your agent to be able to read and act on blockchain data – you want Dither.

Experimenting with AI and Crypto – Dither is your first stop.

If you are using ML and Solana on-chain data – Dither will be your first thought.

This includes everything from vision models reading charts, text embedding transactions to determine ideal holders of a token, or using LLMs for token predictions. The future is bright for applied AI on Solana.

Main: Return to the Main Page

Free Tier: Explore Dither Telegram and Access Free Demos

Premium Tier: Verify and Access Premium Demos

@BondedPump: Access Pump Fun Bonding Directly on Crypto Twitter

@Dither_Solana: Follow Dither AI on Twitter

Hypothesis: Check Out All Our Current Hypothesis

Demos: Explore our Demos and API

AI Thesis: View Our Overall AI Thesis